Crypto markets have traditionally been cyclical based mostly on Bitcoin halving occasions. Bitcoin halvings occur each time 210,000 blocks are mined — roughly each 4 years. The final halvings occurred in 2012, 2016, and 2020.

Between every halving, a bull market has been adopted by a bear. Given the clear nature of most blockchain networks, it’s attainable to evaluate on-chain information to establish patterns and similarities from earlier cycles.

CryptoSlate’s analysis staff has reviewed information from Glassnode and recognized a number of potential bear market backside alerts.

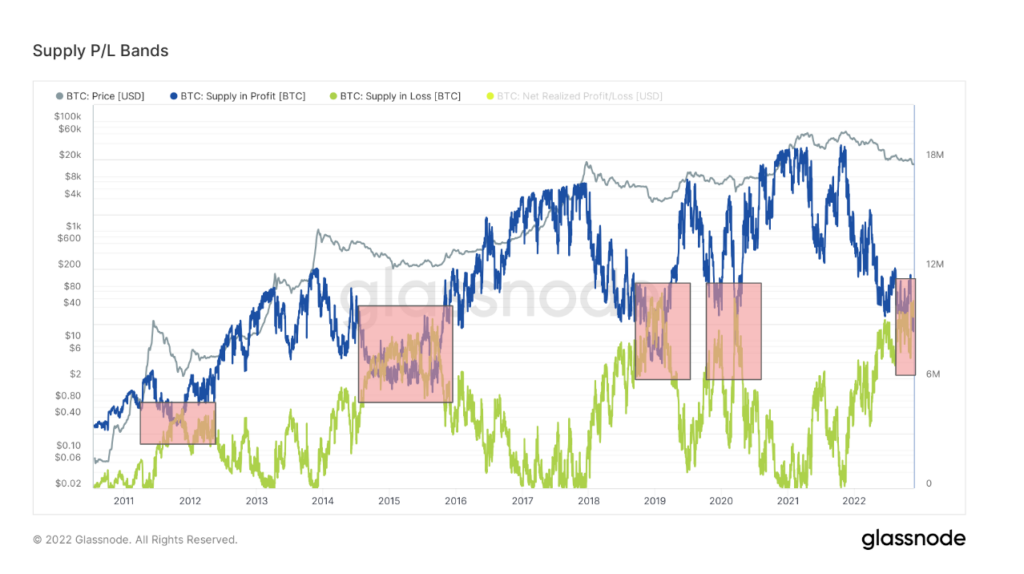

Provide P/L Bands

Provide P/L Bands depict the entire quantity of Bitcoin provide in both revenue or loss. The blue line reveals the entire variety of Bitcoin in revenue; the inexperienced line reveals the quantity at the moment making a loss.

The values symbolize unrealized revenue and loss as the information tracks the worth from the value on the time of the cash’ acquisition by way of buying and selling or mining.

The blue and inexperienced strains have just lately converged for the fifth time in Bitcoin’s historical past. The earlier occasions have been throughout bear markets, near the cycle’s lowest mark.

The outlier was in Could 2020 throughout the world COVID market crash. Except for the COVID black swan, the convergence occurred in 2012, 2014, and 2019. Whereas the overlaps lasted six months to a 12 months, every time Bitcoin’s worth recovered to discover a new all-time excessive inside three years.

The Provide P/L Bands will not be a assured indicator of bear market bottoms, however whereas historical past doesn’t all the time repeat itself, it usually rhymes.

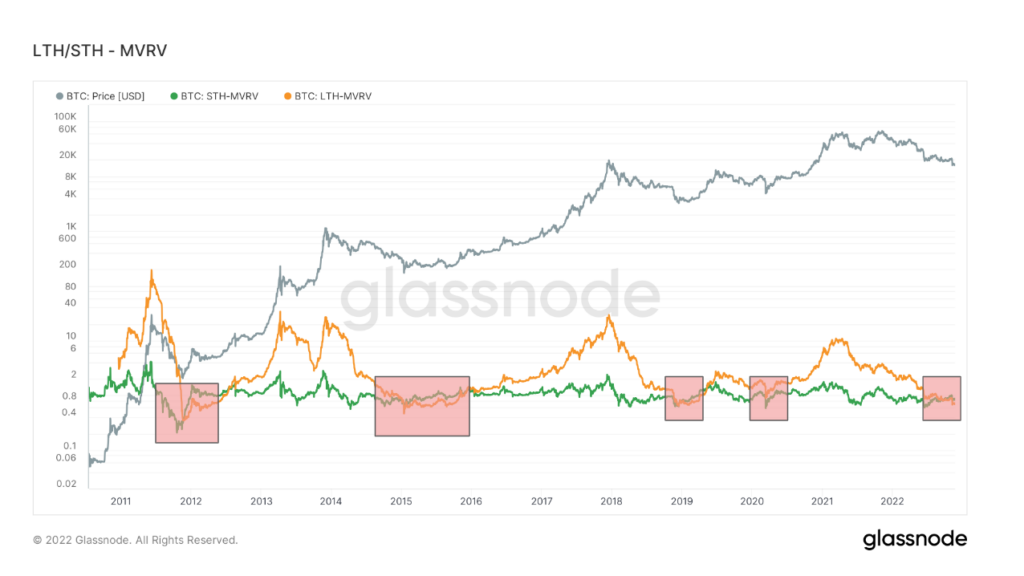

Lengthy-Time period & Brief-Time period MVRV

MVRV is a time period associated to the ratio between the realized and market cap of Bitcoin. MVRV takes into consideration solely UTXOs with a lifespan of not less than 155 days and serves as an indicator to evaluate the habits of long-term traders.

Much like the Provide P/L Bands, the MVRV of long-term holders has solely dropped decrease than short-term holders on 5 events. The intervals are nearly equivalent to the availability chart showing throughout every of the previous bear markets and the COVID crash.

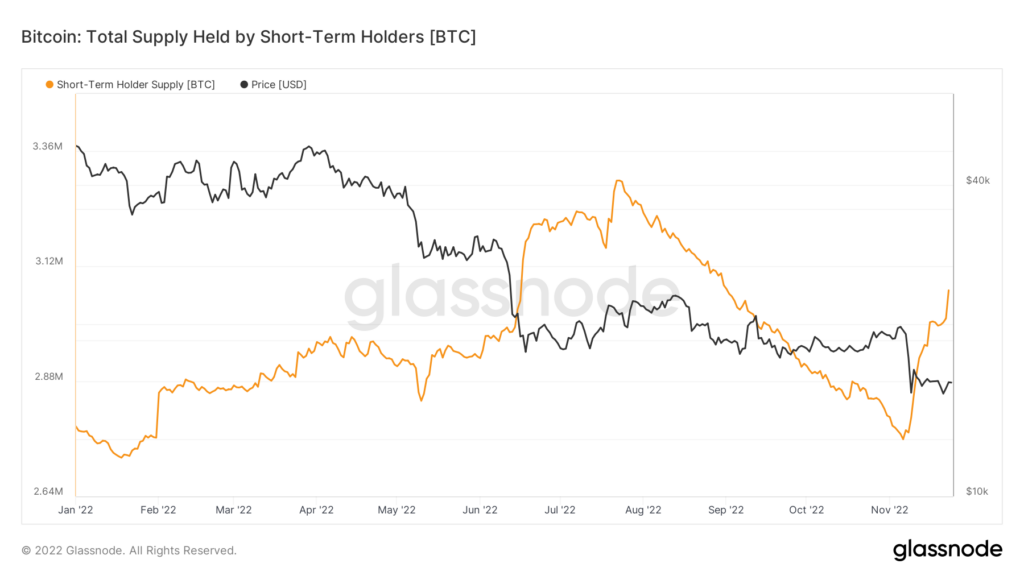

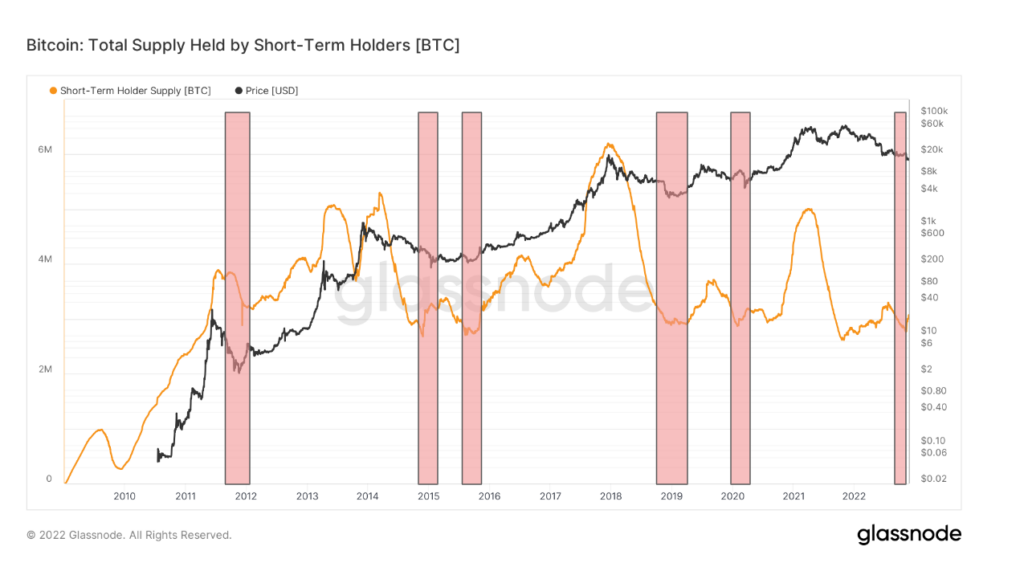

Brief-Time period Holder Provide

The quantity of Bitcoin’s whole provide that short-term holders maintain has surpassed three million cash from the cycle lows. Brief-term holders are sometimes probably the most delicate to cost volatility, and the variety of cash they maintain traditionally bottoms on the base of a cycle.

Zooming out showcases the opposite occasions when short-term holder provide reached related ranges. Nonetheless, not like the opposite metrics, this phenomenon has offered itself on six events since 2011. 4 match the opposite information, whereas short-term holders bottomed in 2016 and 2021.

One off-chain sign of a bear market backside has additionally proven its face in current weeks. When Bitcoin has fallen from its all-time highs previously, the purpose the place main publications declare ‘crypto is useless’ has notoriously marked the underside of the market.

In 2018 Bitcoin was declared dead 90 occasions by main publications, and 125 occasions in 2017, based on 99 Bitcoins. Presently, crypto has solely obtained 22 obituaries in 2022, so we’re a way away from this sign, including weight to the market backside principle.

Solely a fortnight in the past Sam Bankman-Fried was within the stratosphere. However the excessive-speed implosion of FTX has dealt a catastrophic blow to an business with a historical past of failure and scandals. Is that this the top for crypto? https://t.co/bwynnCeCZ3 pic.twitter.com/NWyqHCZzXm

— The Economist (@TheEconomist) November 17, 2022