Glassnode knowledge analyzed by CryptoSlate reveals that new tackle momentum metrics of Bitcoin (BTC) and Ethereum (ETH) mirror that the BTC community is rising whereas the sentiment on the ETH community is the other.

An uptick in day by day lively customers, extra transaction throughput, and elevated demand for backspace usually characterize wholesome community adoption. Contemplating this, CryptoSlate analysts examined the brand new tackle momentum, new entity momentum, and lively tackle momentum metrics for BTC and ETH.

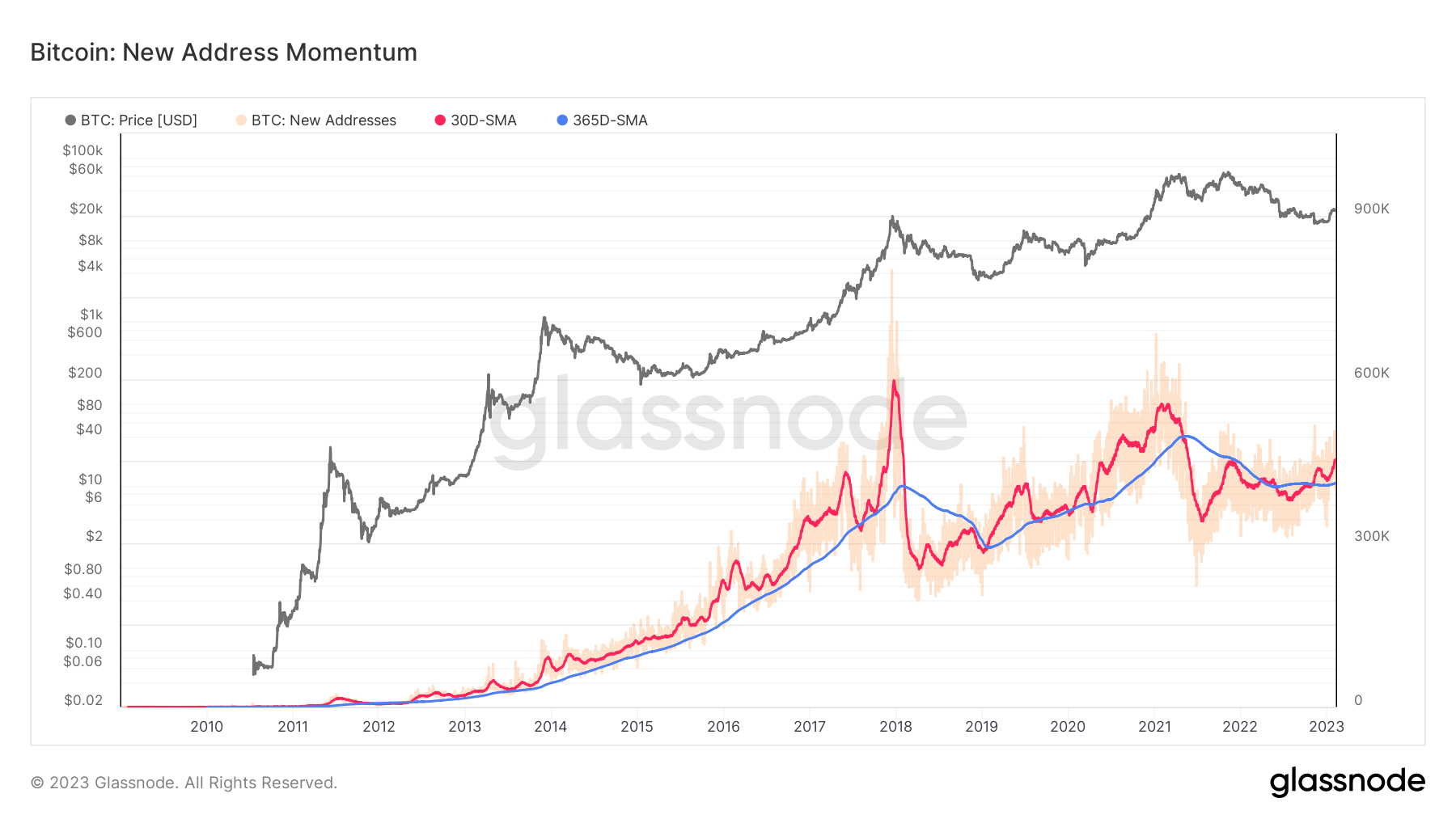

New tackle momentum

The variety of new addresses recorded on-chain might be an efficient device to measure the magnitude, development, and momentum of exercise throughout the community.

Absolutely the variety of new addresses on any given day might be uninformative as a consequence of intraday volatility in on-chain exercise metrics. As an alternative, evaluating the magnitude and development of latest addresses getting into the market on a month-to-month or yearly foundation might be way more informative.

The chart above displays the variety of common month-to-month and yearly new addresses on the BTC chain, that are represented with the purple and blue strains, respectively.

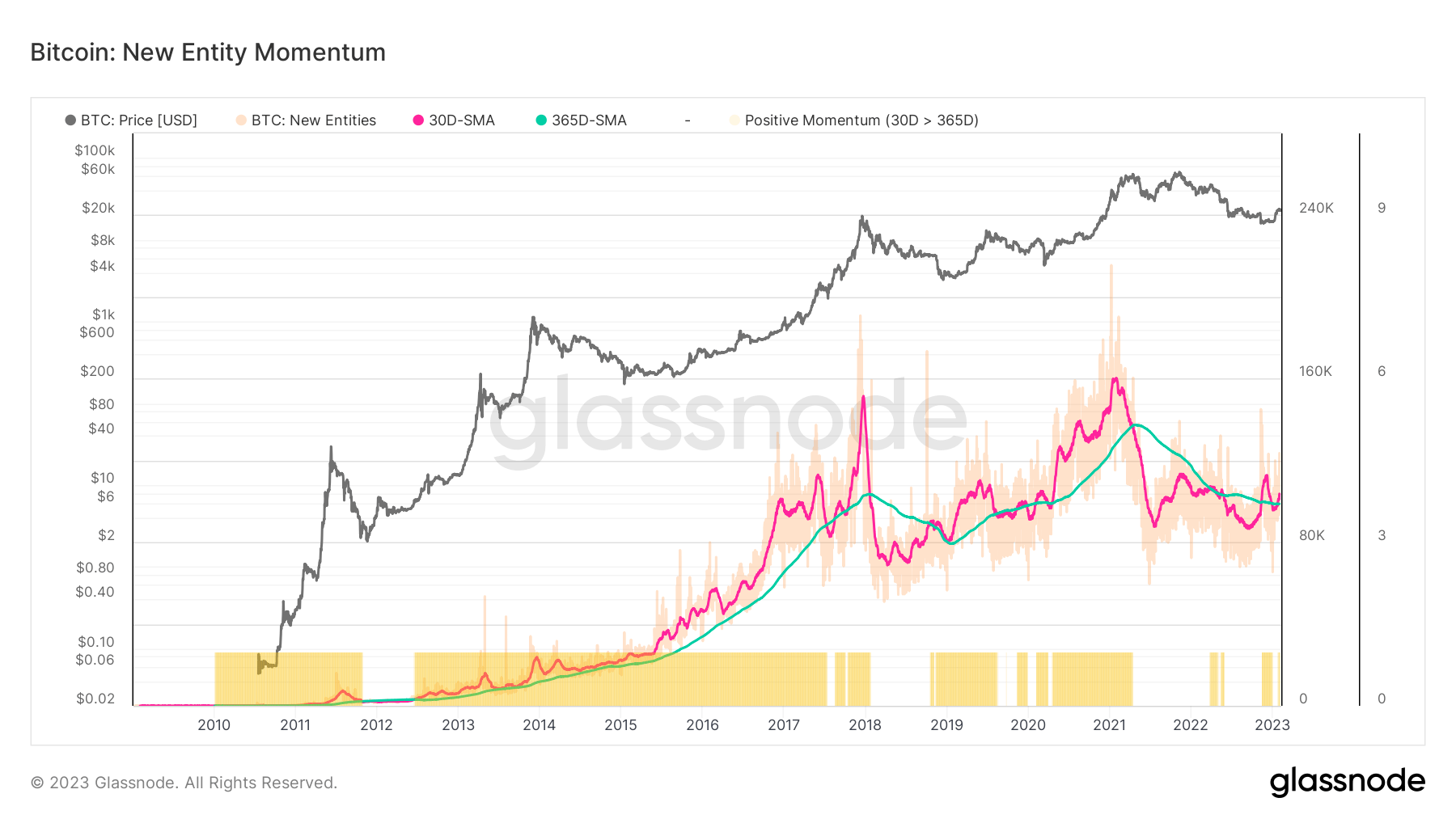

New entity momentum

This metric represents the brand new entities that come to a blockchain and might present significant insights when used along with the brand new tackle momentum metric.

Just like the brand new tackle momentum chart, the chart under represents the common month-to-month and yearly BTC new entity momentums since 2010. The pink line represents the month-to-month common, whereas the inexperienced one displays the annual common.

Each metrics underline relative shifts in dominant sentiment and assist determine when the tides are turning for community exercise. When the month-to-month common surpasses the yearly one, it signifies an enlargement in on-chain exercise, normally reflecting basic community enhancements and rising community utilization.

If the yearly common exceeds the month-to-month common, it signifies a contraction in on-chain exercise, a typical signal of deteriorating community fundamentals and declining community utilization.

The charts point out that at the moment, each BTC’s new tackle momentum and new entity momentum metrics are above the yearly averages. Historic knowledge suggests {that a} bull market sentiment emerged every time these metrics exceeded the annual common. The most recent instance of this may be noticed throughout the first month of 2023, which noticed BTC improve from round $15,000 to $24,000.

This additionally helps the arguments claiming that the bull run in 2021 resulted in mid-2021, and the November bull run wasn’t natural and was pushed by derivatives.

At the moment, we see new entities come into the BTC community in an efficient method for the primary time in 2021. Nonetheless, the stream stopped for a quick interval throughout early 2022, however it may be stated that this era was throughout the finish of the bull run.

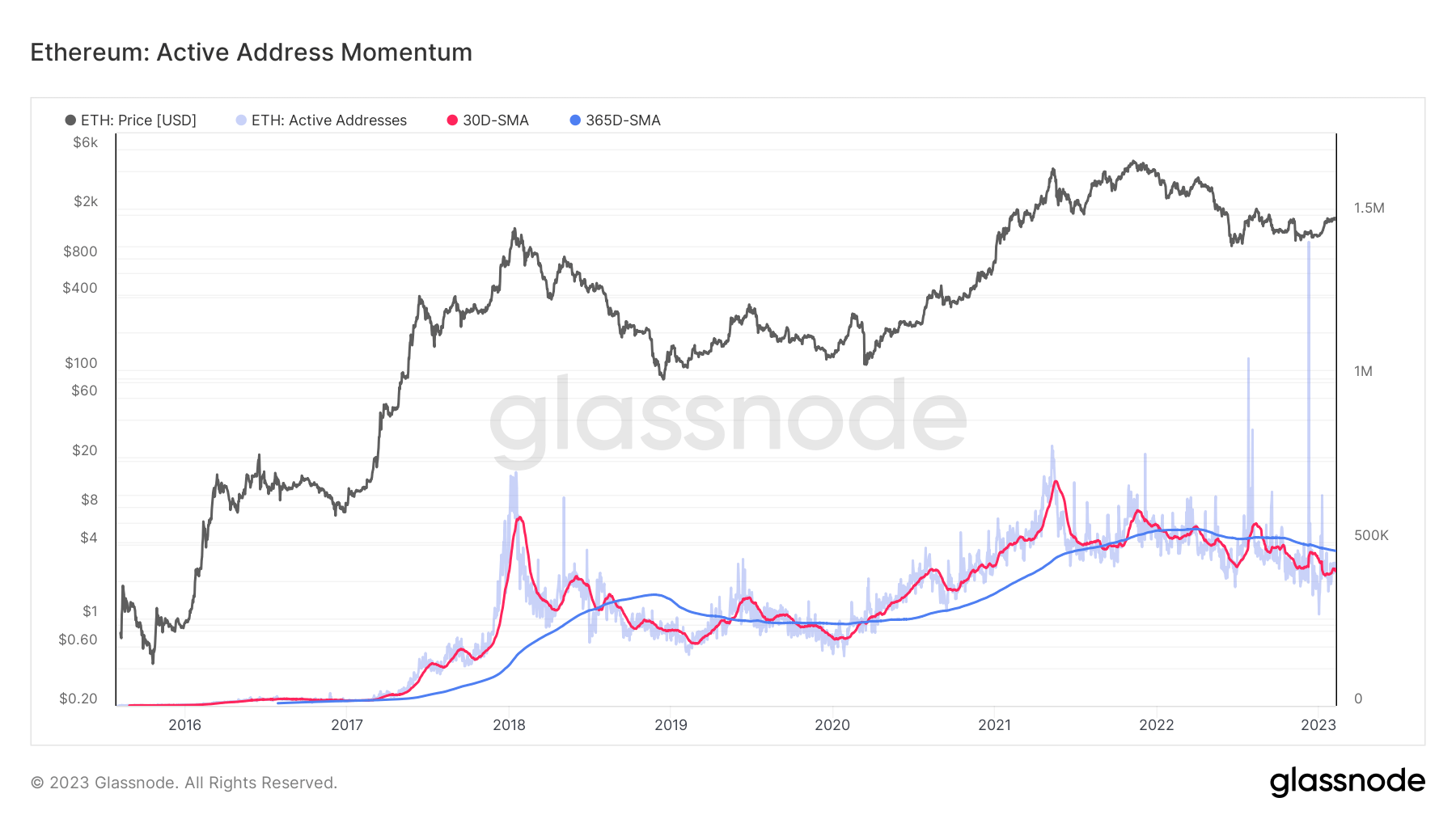

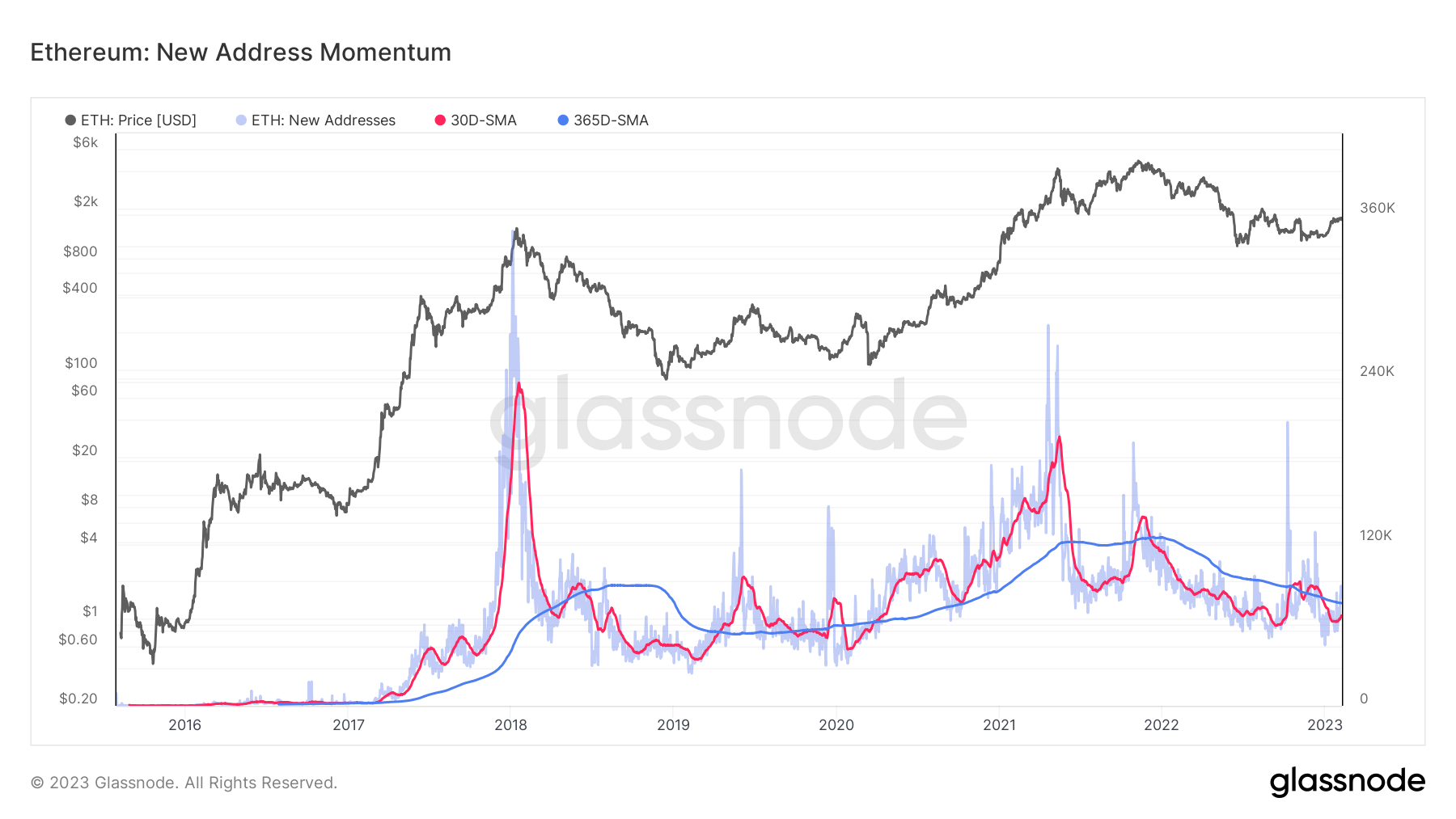

Ethereum

The metrics for ETH mirror a unique sentiment. The charts under signify the common month-to-month and yearly lively tackle momentum and new tackle momentum metrics for ETH.

Each metrics are firmly under the yearly common, suggesting an absence of latest members getting into the community. These metrics have been under the annual averages because the starting of 2021.